Renovation Insurance

A major renovation of your home is something that is excluded by many home insurers. This is especially true if you are managing the works yourself or using labour only contractors. Arranging suitable renovation insurance on your project is an important consideration.

If you are undergoing any type of renovation, alteration or extension to your home, it is important to notify your existing home insurer. While coverage is sometimes offered, it will be limited and may not adequately protect you against risks of collapse, liability or theft of materials. Purchasing a Protek renovation policy can provide the adequate cover you need even if the property is occupied or unoccupied. This is beneficial if the project is being purchased at auction.

How does renovation insurance work?

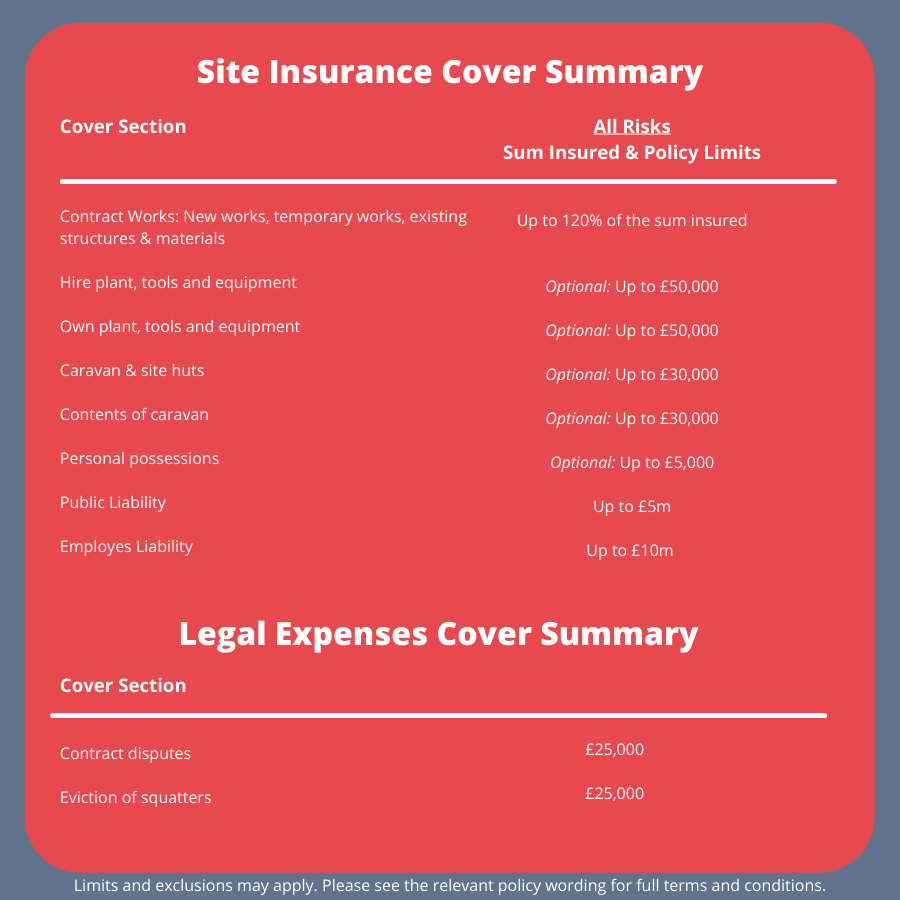

Renovation insurance covers you for the existing element of the property that’s being renovated together with all the new renovation works. We cover all sorts of projects. So, the existing structure can be a house or commercial building. If the property collapses while creating a new opening in a wall, then renovation insurance can cover it. The policy completely replaces the requirement for buildings insurance. This is because home insurance is not usually suitable. All the works, including any temporary works, materials, plant tools and equipment will need to be covered. Public liability and employers liability is automatically included to ensure you are adequately protected. In addition, we can cover the contractual liability associated with a Party Wall Agreement between you and a neighbouring property.

When do I need to arrange cover?

Home renovation insurance needs to be in place either from the moment you plan to start works or exchange of contracts if the property is unoccupied or currently uninsured. It should then continue to the point the project is completed and taken into full use. We can provide cover from three months to two years and these periods can be further extended.

Call us: 0333 456 8030

What type of renovation policy do I need?

Our staff have many years’ experience in helping people get suitable cover in place for their projects. We have designed our renovation insurance product to be inherently flexible. There are many options available as well as choice of cover duration. It is comprehensive and competitive.

If you are utilising a contractor to carry out the works, issues may arise as to who is contractually responsible for insuring the existing structure because the contractor’s insurance may not cover it. Renovation insurance can solve that issue quite simply.

Why you should consider having renovation insurance in place on your project

It’s not just serious losses like a fire or flood that you need to consider being protected against. Claims for theft of materials, plant tools and equipment can become quite expensive if not insured. A collapse whilst knocking through to create an opening may have disastrous consequences for your house. Vandals gaining access to the part completed project could cause a huge amount of damage and destruction. Even if they don’t steal anything. The remoteness of a site just adds to the issue. You may have neighbours in close proximity and accidental damage to their property can become an expensive and emotional problem.

Building sites are hazardous places of work – injury sustained by contractors, friends, or visitors to site – whether invited or not – can become your responsibility. Claims for injury are usually very large and can result in prosecution. It is just not worth leaving your project uninsured. Protek’s renovation insurance can provide the cover required on your project.

Party Wall Agreements

If you are proposing to carry out work within three or six meters of a party or boundary wall, you will invariably have to consider your liability under the Party Wall Act 1996. Under the terms of the Act, your neighbour has a right to be compensated for any loss or damage caused by your relevant works. If you cause damage to the neighbouring property inadvertently, public liability may not provide protection as it could be seen as a foreseeable loss. However, cover for your contractual liability can be included under Protek home renovation insurance as an option on any project where you have evidence of a party wall agreement in place.

Never run out of cover

Protek recognises that projects do not always run to schedule, which is why we have flexible cover periods on offer and the ability to purchase short-term policies to effectively top up cover as required.

Legal expenses

You can optionally include legal expenses (professional fees insurance) during the quotation process. It provides cover for contractual disputes with the contractors, trades and professionals involved with your project. This means that if things are not going to plan because you are in dispute you can gain legal help, assistance in seeking resolution. You should bear in mind that legal expenses cover relies on you having contracts in place evidenced in writing. If you are not using written contracts, then legal expenses cover may not be suitable. Advice on arranging contracts is available here.

Do not forget that you may also need to consider a structural warranty, which covers the new works and consequential damage to the property for 10 years against defects in the design, workmanship, materials and components causing major damage. For more information, see our structural warranty page.