Self Build Mortgage

![]()

A self build mortgage is designed to help people fund the construction, renovation, or conversion works necessary to create their own homes. They differ from traditional mortgages in several key ways, including having different eligibility criteria and products available. With a self-build mortgage, it’s important to consider what is involved and how they work. Below, we will highlight the key stages involved and what borrowers can expect.

Download our Self Build Mortgage and Homebuilding Finance Leaflet

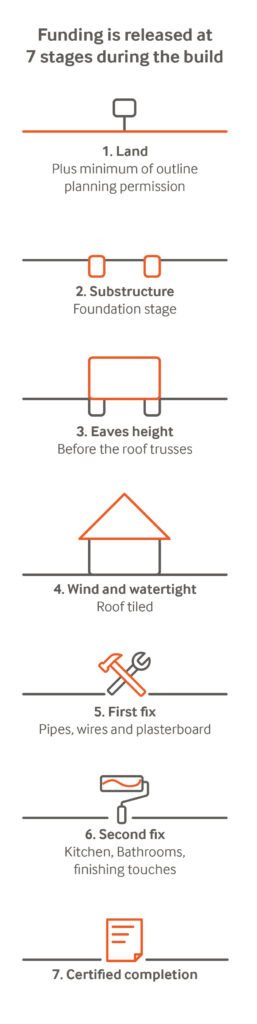

Self Build Mortgage – 7 Key Lending Stages

Funds are released at each stage as the build of the property progresses with the amount released at each stage differing as they can require different amounts of money. The actual amount for each stage depends on the project itself and will differ for each property. When applying for a self-build mortgage, borrowers will have to provide detailed plans and costings to show they have a realistic budget and that the project is actually feasible.

Fully tailored funding solution

Interest rates on self-build mortgages are typically higher than on regular residential mortgages which is due to the increased risk to mortgage lenders. Protek is delighted to offer customers a tailored funding solution delivered by expert mortgage advisers. Peritus Private Finance is fully independent and searches the whole market to secure you the best possible deal.

Case Study – High Loan To Value Self Build Mortgage

As a first-time self-builder, the client’s income was good so there were no concerns in terms of affordability. However, they were on a strict budget with limited cash available for both the plot purchase and the build itself. It was therefore imperative that a lender be sought that could work to a higher loan to value to fit within the budget. One of our specialist advisers Matt, was thankfully able to quickly source a product that met the client’s needs and budget, resulting in a client successfully being able to complete their build.

Case Study – Variable Income

There are many aspects of a self-build mortgage that are different to that of a traditional purchase mortgage. With a self-build mortgage, the amount that can be borrowed is determined by a client’s income and expenditure. A client (husband and wife) enquired about wanting finance to purchase the land and build a new home. The clients had located a plot of land to build the home, but the husband’s income comprised salary, overtime, and bonuses. The wife had a business with only one year’s accounts. Lenders generally will look at overtime and bonuses in very different ways. They will also typically require someone who is self-employed to have two years’ sets of accounts.

The adviser managed to source a lender that could take the bonus and overtime more favorably than others and use the self-employed income with one year’s set of accounts. As a result, the clients were able to obtain the mortgage amount required and able to complete their build.

For expert advice on how self build mortgages work, how to get one, plus the latest rates, simply get in touch below or call 0333 456 8030.

Protek provides site insurance and structural warranties as well as building control and technical auditing services for self-build, renovation, conversion, and extension projects. An introduction, where relevant will be made to Peritus Private Finance.

Mortgage Advice provided by: Peritus Private Finance Ltd, 1 Bankside, The Watermark, Tyne & Wear NE11 9SY Registered in: England and Wales Reg No. 03490834. Peritus Private Finance Ltd is authorised and regulated by the Financial Conduct Authority.

Your home may be repossessed if you do not keep up repayments on your mortgage.